Over the last couple of years, personal wallets have transformed from the physical, leather wallet with your driving license, a couple of bills and coins and a picture of your kids, to a digital list of cards that you can open with a double tap on your iPhone. Soon enough, this digital wallet will undergo another transformation. How easy would it be if you can use your phone to prove your identity to securely access government portals, make safer purchases and ensure control over your medical data? This is exactly where eIDAS 2.0 comes in.

eIDAS, or Electronic Identification and Trust Services, is a European Union regulation that aims to ensure secure and reliable electronic identification and trust services across the EU. With the European Digital Identity Wallet, a key pillar of eIDAS, all EU citizens will be able to store digital versions of important documents safely, putting you in control of your own data and privacy.

“For all digital services, proving your identity with the digital wallet will be the new way to go.” – Boris Goranov, CEO at Ubiqu

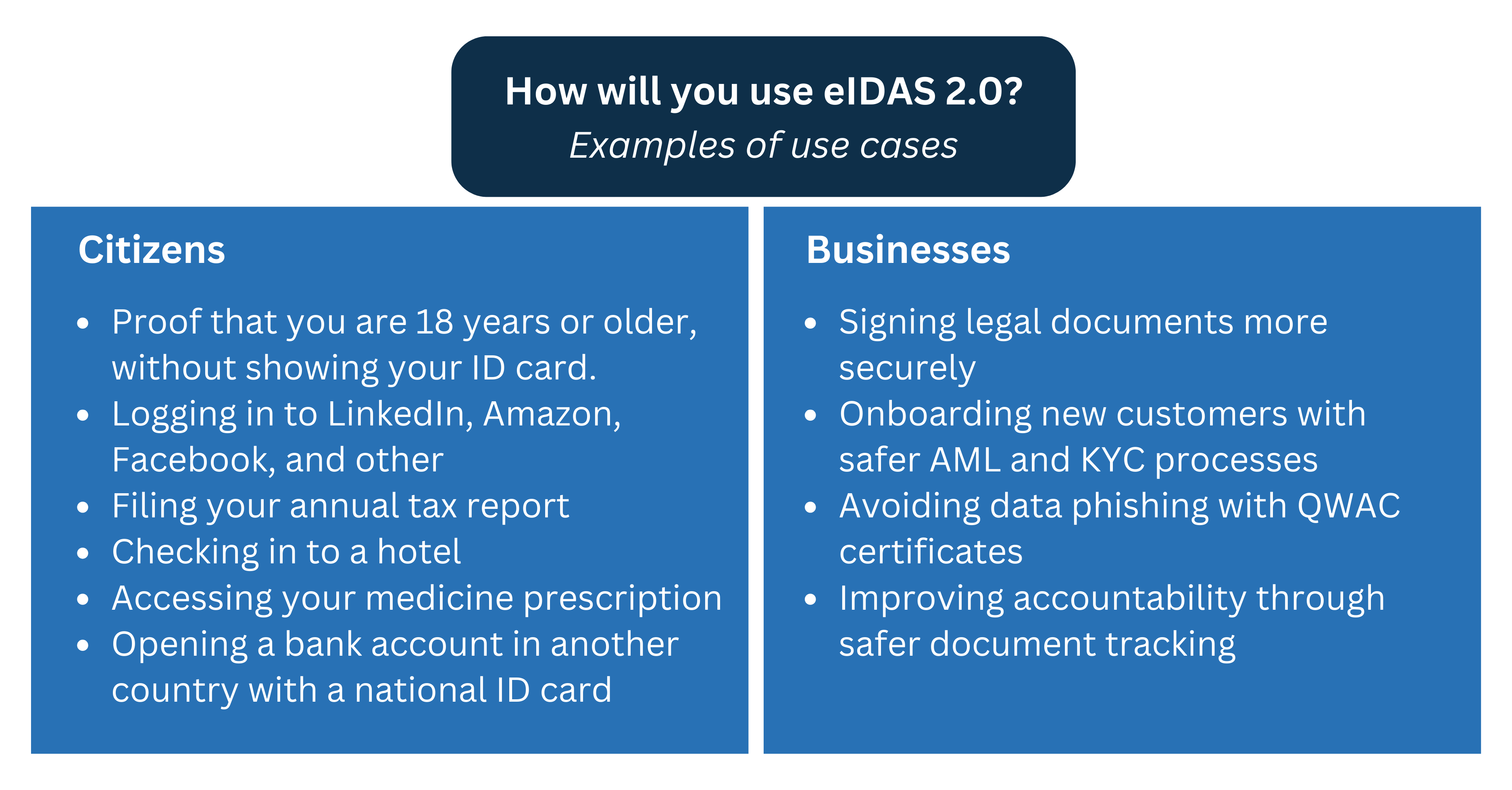

The impact of eIDAS 2.0 extends far beyond government services: the digital identity transformation will provide opportunities for every industry. Companies across various sectors, including transport, energy, banking, health, and education, and particularly those requiring robust online identity verification, will need to integrate these digital IDs. As we are launching into a new era of digital identity, understanding and preparing for the upcoming changes is essential.

In this article:

- eIDAS 2.0: A new era of digital identity

- Decentralized digital identity: How it works

- Looking forward: A quick overview of eIDAS preparations

- Implications & challenges

- This is how Ubiqu can help

eIDAS 2.0: A new era of digital identity

The eIDAS regulatory framework was initially launched in 2014. The regulation focuses on two key pillars:

- National electronic identification schemes (eIDs) – which will be used by individuals and businesses to access public services across the EU

- A European internal market for trust services – which will work across borders and have the same legal validity as traditional paper-based documents

eIDAS 2.0, which has entered into force last month, has expanded its scope to encompass a broader array of online trust services. Improvements include:

- Registered electronic delivery services

- Electronic certificates for identity verification

- Digital seals tailored for electronic documents

- Significant cybersecurity updates

Yet, the common goal of the regulation remains the same: Promoting trusted digital identities for all Europeans, allowing users to be in control of their own online interactions and presence.

Decentralized digital identity: How it works

eIDAS 2.0 focuses on decentralized identity. This puts the user central, by allowing them to centrally collect and store credentials and use them for identification and authentication. Verifiers can verify the validity of the user’s credentials without the issuers knowing or tracking the users: the user is the linking pin between the two parties, which eliminates the need for a third, external party.

More concretely, EU citizens will be able to use the European Digital Identity (EUDI) Wallet. Think of it as an extensive wallet on your phone where, besides using it for shopping online or logging into websites, you can show things like your ID, driver’s license, school certificates, medical information, or work ID easily and safely.

Although digital wallets will not be mandatory, the goal is to have them available to most Europeans by 2030 – and the EU expects 80% of citizens to eventually use them.

Find eIDAS’ timeline in the image below:

The EUDI Wallet will change the digital world, and organizations need to be ready for its adoption. This is where Ubiqu comes in, by helping your organization issue an eIDAS 2.0 approved wallet.

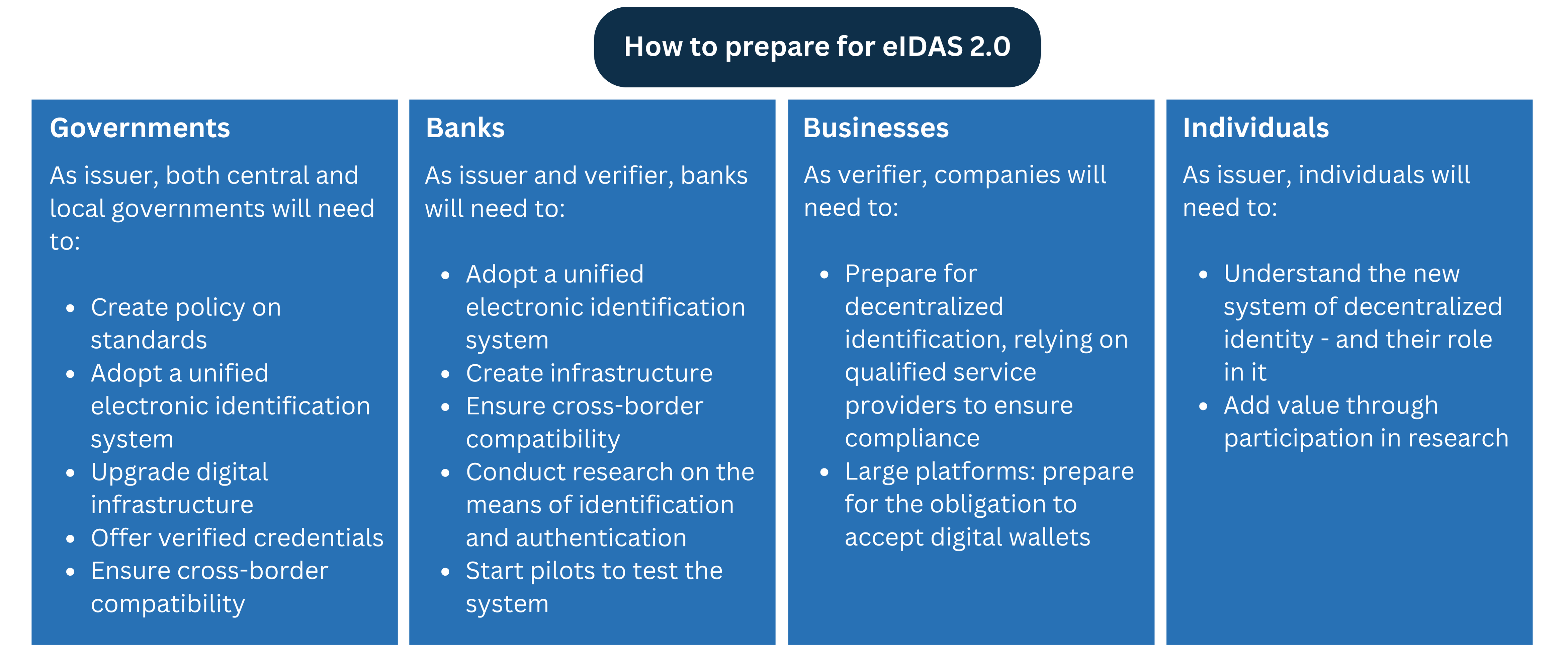

Looking forward: A quick overview of eIDAS preparations

Preparation is key. While all individuals and companies will eventually be familiar with eIDAS 2.0, a good understanding of the regulation will put your organization ahead of the competition.

“While many organizations are just starting to prepare for implementation, Ubiqu has come up with the solution for transitioning from eIDAS 1.0 to the more demanding eIDAS 2.0. We are now ready to help organizations implement this solution.” – Boris Goranov, CEO at Ubiqu

Implications & Challenges

The original eIDAS rules led to different views across different member states, causing inconsistencies in the use of the framework. While eIDAS 2.0 addresses this issue by going into more detail on the requirements and guidelines, the model of decentralized identity is still an emerging one, and has not yet been implemented nationally – let alone across borders.

The implementation of eIDAS 2.0 also creates a new market for data providers, wallet providers and Qualified Trust Service Providers (QTSPs). These parties will shape the way the system develops – an increasing number of wallet providers and credential providers will stimulate use cases and cause a level of competition, by giving users the opportunity to switch wallets once there are enough verifiers. This poses questions on market consolidation: should there be a maximum on the number of apps to be available?

Other practicalities like the degree of decentralization, the ownership of the credentials, and the business model for credential issuers have also come up in the development of the system.

It has become clear that the development of eIDAS 2.0 is far from ready: many questions and challenges need to be faced.

The success of the implementation of the model depends on the key players, by finding an answer to these questions. As the digital landscape continues to evolve, eIDAS 2.0 and compliant service providers like Ubiqu will therefore play a pivotal role in making secure and seamless electronic identification and trust services the new normal.

This is how Ubiqu can help

As you adapt to eIDAS 2.0, it is vital to rely on qualified service providers to ensure compliance. At Ubiqu, we offer a range of solutions designed to meet the stringent requirements of eIDAS 2.0, which is helpful both for governments and businesses alike. Our services not only ensure compliance but also offer enhanced security, reliability, and user-friendliness, essential factors for building trust in digital transactions.

“Ubiqu’s framework revolutionizes trust in data sharing, by improving identity verification and simplifying complex digital tasks. At the moment, we’re ahead of the curve in creating a high-compliance eIDAS 2.0 wallet, incorporating the highest security level for identity cards and passports.

As a ten-year pioneer in digital security, Ubiqu accelerates the eIDAS 2.0 transition by facilitating immediate, effective action within the ecosystem. Our collaborations in the Netherlands with partners like KPN, Xlinq, and Cleverbase ensure alignment and certainty, leveraging open standards and existing technology to minimize implementation risks and timeframes, often to several weeks.’’ – Boris Goranov, CEO at Ubiqu

For organizations looking to navigate the eIDAS 2.0 landscape successfully, Ubiqu provides a tailored approach to meet specific compliance requirements. Discover how we can help you by contacting us directly.