Digital identity services: a natural path for telcos

Choose how to comply with eIDAS 2.0: with our EUDI wallet technology, our QTSP certification service or as a full-service digital identity provider. Each option helps you turn eIDAS 2.0 requirements into revenue while strengthening customer relationships.

challenge

eIDAS 2.0: not a challenge, but a business opportunity for telcos

- You have to act anyway: Telcos with 1M+ customers must accept digital wallets

- And EU member states too: by 2026 each state must launch Digital ID Wallets, with an 80% citizen adoption by 2030.

- Customer loyalty is decreasing while competition is growing. Traditional telco services alone are no longer enough to retain customers.

- Strategic challenge: The digital identity market is emerging rapidly. Telcos must decide whether to simply comply with wallet acceptance or take a leading position as trust service provider

‘’A future-proof solution goes beyond eIDAS 2.0.’’

“Digital identity isn’t just about compliance—it’s about the bigger picture. You need a solution that protects citizens’ data, guards against cyber threats, and ensures a seamless user experience.

A future-proof digital identity solution must be scalable, secure, and proven. It must evolve with future demands and work across borders. Without it, your digital identity initiative won’t withstand future challenges. There’s no room for half measures.”

– CEO at Ubiqu

What we do

How Ubiqu supports telcos

with digital trust solutions

Choose how to comply with eIDAS 2.0: with our EUDI wallet technology, our QTSP certification service or as a full-service digital identity provider. Each option helps you turn eIDAS 2.0 requirements into revenue while strengthening customer relationships.

Our Remote Secure Element (RSE) delivers cloud-based security that works across all devices, surpassing traditional SIM or phone-based solutions. Give customers secure access to their digital identity anywhere, using just a PIN.

Our QTSP-certified technology accelerates your certification journey, with our experts handling 90% of compliance documentation. Trusted by government agencies, major telcos like KPN, and financial institutions.

Enable government agencies and organizations to issue digital certificates through your platform. Our comprehensive partner program provides the infrastructure, compliance support, and operational expertise you need to become their trusted digital identity provider.

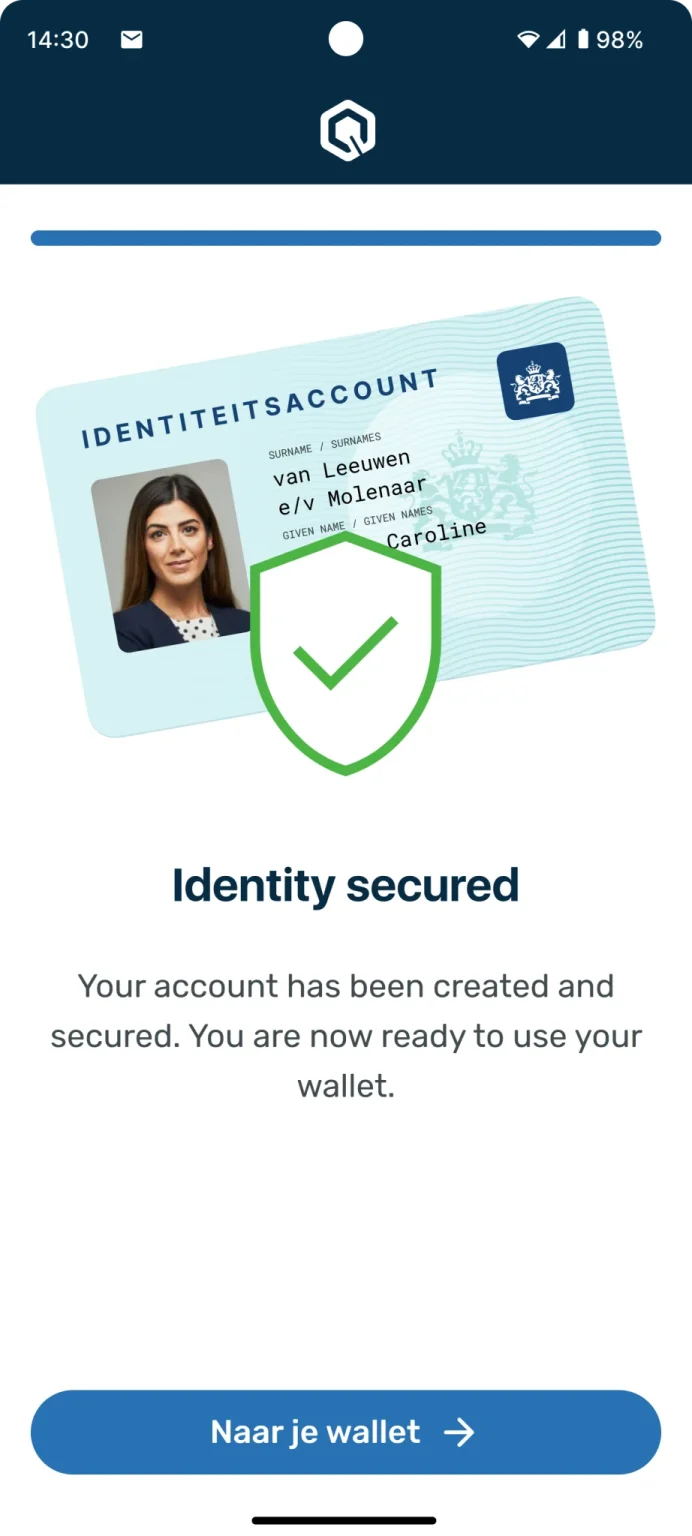

1. Launch your branded digital wallet

Our Remote Secure Element (RSE) delivers cloud-based security that works across all devices, surpassing traditional SIM or phone-based solutions. Give customers secure access to their digital identity anywhere, using just a PIN.

2. Get QTSP Certified in 3 Months

Our QTSP-certified technology accelerates your certification journey, with our experts handling 90% of compliance documentation. Trusted by government agencies, major telcos like KPN, and financial institutions.

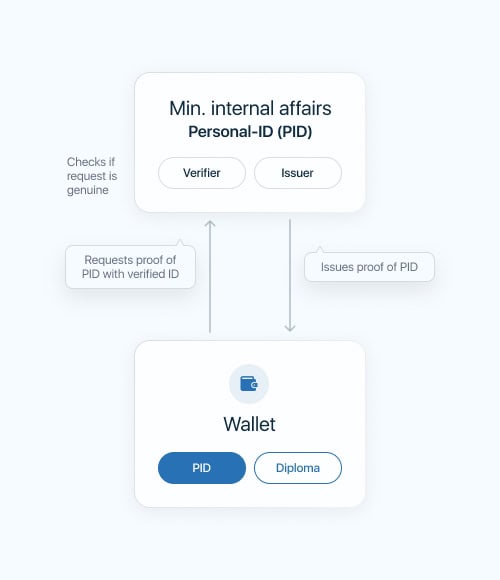

3. Become a full-service digital identity provider

Enable government agencies and organizations to issue digital certificates through your platform. Our comprehensive partner program provides the infrastructure, compliance support, and operational expertise you need to become their trusted digital identity provider.

![]() With the wallet…

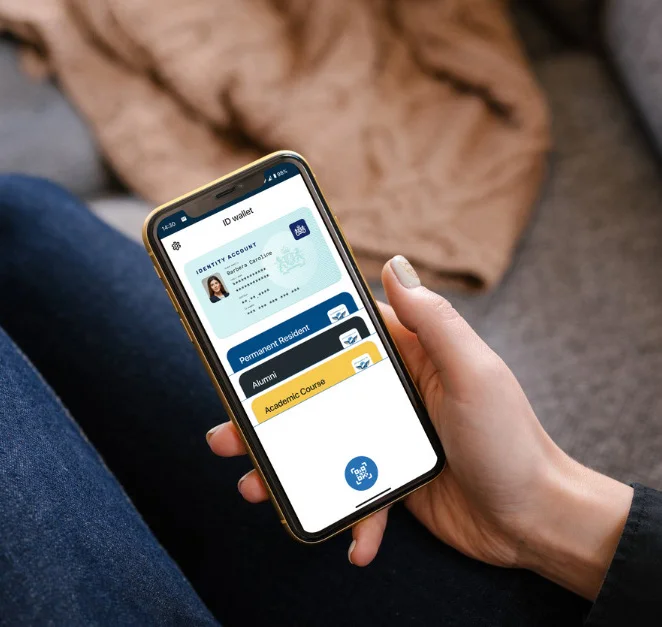

With the wallet…

we are bringing all of the contact moments to prove your identity together. Ubiqu’s technology serves as a vital layer that unifies these processes, enabling us to combine all of these moments.”

Harm Roosendaal

Product Manager Digital Identity and Trust Services, KPN

our technology

Remote Secure Element

Our patented Remote Secure Element (RSE) allows users to securely store their hardware element in a data center, accessible anytime with just a PIN code. Ubiqu ensures persistent and uninterrupted identification – a one-time NFC passport scan is all it takes, driving high user adoption and making identity fraud a thing of the past.

How KPN builds digital identity services with Ubiqu technology

The Dutch telco KPN, one of the few Qualified Trust Service Providers in the Netherlands, partnered with Ubiqu to develop a digital identity platform meeting eIDAS 2.0 requirements. While KPN maintains QTSP responsibility, Ubiqu’s modular technology enables rapid development and flexible integration of identity verification services across sectors – from healthcare to housing – through a single digital wallet.

What we offer

The Ubiqu difference

Our Remote Secure Element (RSE) technology delivers high-level security without relying on phones or SIM cards. Users can securely access their digital identity from any device, making it more convenient and accessible than traditional hardware-dependent solutions.

Our cloud-based platform enables seamless integration across services while eliminating dependencies on specific devices or telecom providers. This device-agnostic approach ensures maximum scalability and flexibility for both providers and users.

Our technology enables selective disclosure, allowing users to verify specific attributes (like age) without revealing unnecessary personal information. This privacy-by-design approach ensures compliance with eIDAS 2.0 and data protection regulations.

Choose the integration level that matches your needs – from implementing our wallet technology to becoming a complete identity service provider. Our modular approach allows you to start small and expand your services as your needs change.

Our Work