eIDAS 2.0: Everything you need to know

The world is becoming increasingly digital, leading us to rely increasingly on online services. But how can you be sure that you are safe online? This is where eIDAS 2.0 comes in.

eIDAS 2.0, the renewed framework for digital identification and trust services introduced by the European Union, enables citizens and companies to identify themselves and exchange data securely online. With the arrival of eIDAS 2.0, Europe is taking a major step towards offering reliable digital identities for all its citizens. But what exactly does eIDAS 2.0 entail – and what does it mean for you?

In recent years, our personal wallets have been transformed from a physical version with cash, a driver’s license and a picture of our loved ones, to a digital version on your iPhone. Soon, this digital wallet will transform again.

Imagine how convenient it would be if you could just use your mobile phone to prove your identity, for example for secure access to government portals, safer purchases and control over your medical data? This is exactly where eIDAS 2.0 comes in.

The impact of eIDAS 2.0 goes beyond government services: it is a revolution in digital identity. It offers opportunities for every industry: companies in transport, energy, banking, healthcare, and education will all be able to take advantage of a more secure and efficient framework.

As we enter a new era of digital identity, it is therefore essential to understand and prepare for the developments.

What is eIDAS 2.0? A new era of digital identity

The eIDAS 2.0 regulation, an update of the original eIDAS regulation from 2014, aims to make digital identities even more secure and accessible. With your digital identity, you will be able to easily log in to government services or make online purchases, for example, without having to worry about your privacy or the security of your data. With eIDAS 2.0, you are in control of your own data. This legislation ensures that all electronic identification and trust services are secure and legally valid, throughout the entire European Union.

What does eIDAS mean?

eIDAS stands for Electronic Identification And Trust Services. It is a European regulatory framework that enables secure and reliable electronic interactions between citizens, businesses and governments in the European Union. Thanks to eIDAS, you will be able to access services in all EU member states with a single digital identity, without having to use different accounts or identification systems.

The difference between eIDAS, eHerkenning and DigiD

Unlike eHerkenning and DigiD, the current Dutch digital identity systems, eIDAS also works beyond national borders and offers a broader, European approach to international services.

“For all digital services, proving your identity with your digital wallet will become the new standard.”

– Boris Goranov, CEO van Ubiqu

Will eIDAS be mandatory?

The use of eIDAS 2.0 will not be mandatory for citizens, but the EU expects most people to use it by 2030. These digital identity wallets, which will be known as European Union Digital Identity Wallets (EUDI Wallets), will become a useful tool for many. For companies that offer services that require identity verification, the integration of eIDAS is therefore strongly encouraged.

Who is eIDAS for?

eIDAS 2.0 is intended for everyone: citizens, businesses and governments. Citizens can use eIDAS to securely and easily access public and private services throughout the EU. Businesses can use reliable and secure identity verification to better serve their customers. And thanks to eIDAS, governments will now have a uniform and secure way to offer their services to citizens, regardless of their location in the EU.

Benefits of eIDAS 2.0

For citizens:

For organizations:

For governments:

How does the EUDI Wallet work?

The EUDI Wallet, or European Union Digital Identity Wallet, is the digital wallet of the future. With this app on your smartphone, you can securely store your digital identity, driving licence, medical information, and other important documents. For example, when you want to access a government service or online store, you use the EUDI Wallet to prove your identity. You are always in control of what information you share, and no more data is shared than necessary. In addition, document issuers cannot see who you share your data with.

Examples from different sectors

Banking

Customers are able to securely and easily identify themselves, in order to open accounts or take out loans.

Healthcare

Patients can securely access their medical records and share them with healthcare providers in a secure way.

Transport

People can verify their identity more quickly at border crossings or airport checkpoints.

Education

Students can easily access educational services and share their degrees securely with potential employers.

Decentralized digital identity: what does this mean for users and businesses?

With a decentralized identity, you, as a user, have full control over your data and decide what you store in your digital wallet and who you share it with. Organizations can verify the authenticity of your data without third parties – even the original issuer – being notified. This increases privacy and security, because your identity does not have to be registered with different institutions every time.

eIDAS 2.0 will encourage the emergence of wallet providers, data providers and Qualified Trust Service Providers (QTSPs), creating competition and giving digital identity users more choice. However, this raises questions about market consolidation: how many apps should be available? Other questions about ownership, decentralization and business models will also need to be answered. It is clear that the development of eIDAS 2.0 is far from ready: there are still many questions and challenges arising.

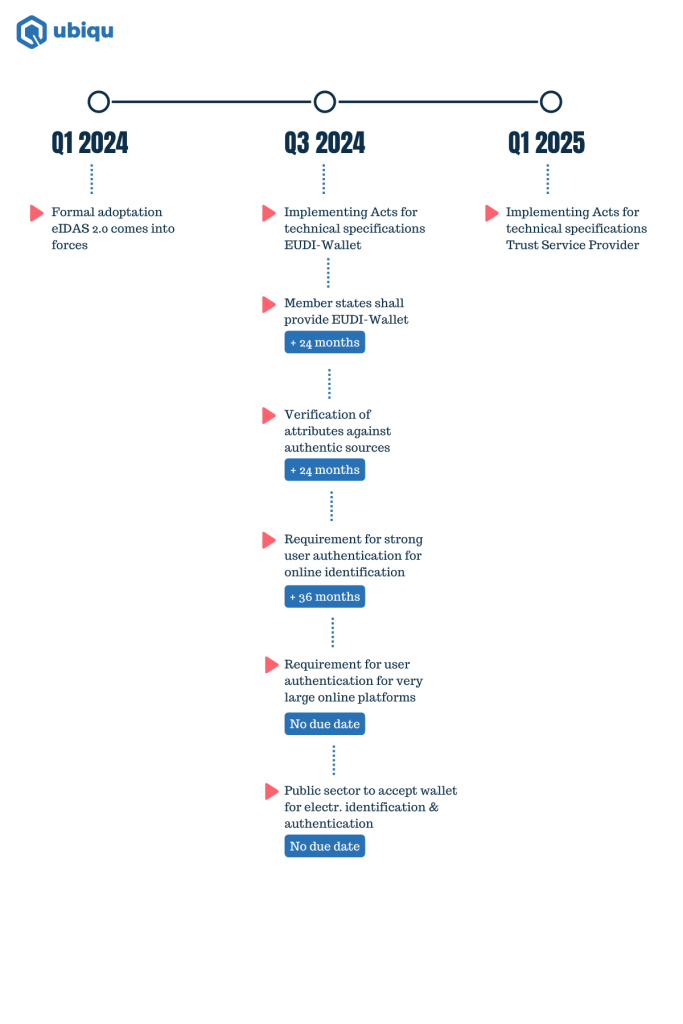

What’s the eIDAS 2.0 timeline?

eIDAS 2.0 has entered into force in 2023, and will be implemented in a phased manner over the coming years. The goal is for at least 80% of European citizens to use an EUDI Wallet by 2030. Organisations must therefore prepare now to integrate this technology in order to be ready for full adoption in time.

Legal and technical requirements for companies and governments

To comply with eIDAS 2.0, businesses and governments must adhere to strict cybersecurity and data protection regulations, such as strong authentication, secure data storage and GDPR compliance. For businesses, this means that they may need to adapt their existing systems to be able to verify eIDAS-certified digital identities.

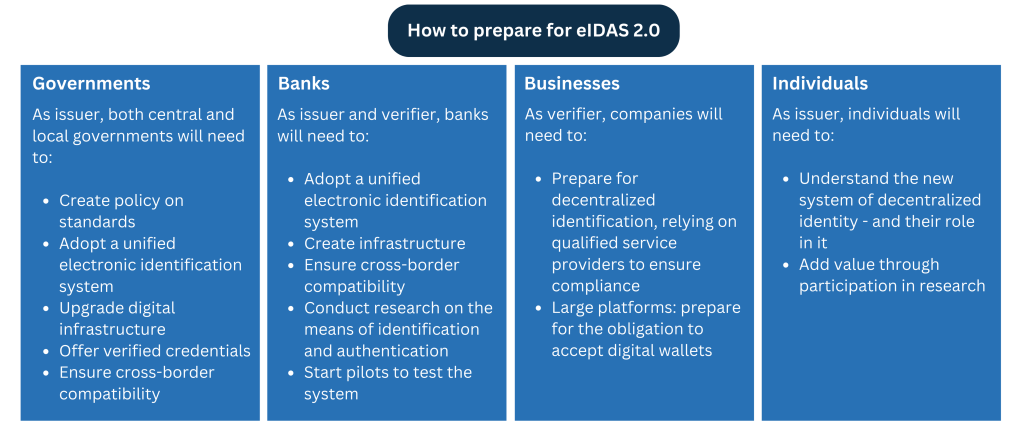

What preparations are needed for eIDAS 2.0?

Preparation is key. Eventually, all organizations will be familiar with eIDAS 2.0, but you can certainly gain a head start on your competitors by delving into the regulation – or even preparing to become a QTSP (Qualified Trust Service Provider).

eIDAS 2.0 compliant through QTSP certification

As a QTSP, you can provide qualified trust services, such as digital signatures, e-seals and identity verification, that meet the strictest European standards. This way, you are not only eIDAS 2.0 compliant, but you also strengthen the trust of customers and partners in your digital services.

Furthermore, it enables you to connect to the EUDI Wallet, giving you a head start in the digital identity market. By investing time and resources in the certification and audit processes now, you can meet the new requirements in time and gain a competitive edge. Ubiqu can help you become a QTSP in three months.

Implementation challenges for companies

With the arrival of eIDAS 2.0, the digital identity landscape will change dramatically. Companies active in online transactions, digital identification and trust services are facing a number of crucial challenges.

How Ubiqu can help

When preparing for eIDAS 2.0, it is important to be able to rely on qualified service providers. At Ubiqu, we offer a range of solutions designed to meet the stringent requirements of eIDAS 2.0, which can benefit both governments and businesses. Our services not only ensure compliance, but also offer enhanced security, reliability and usability, essential factors for building trust in digital transactions.